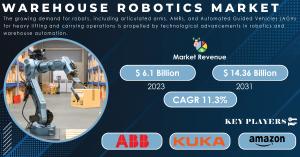

Warehouse Robotics Market Size to Hit USD 14.36 Billion, at a CAGR of 11.3% by 2031, Fueled by E-Commerce Boom

Warehouse Robotics Market Size, Share, Growth Drivers and Regional Analysis, Global Forecast 2024 - 2031

AUSTIN, TEXAS, UNITED STATES, May 16, 2024 /EINPresswire.com/ -- Market Size & Growth OutlookThe SNS Insider report forecasts a promising future for the warehouse robotics market, estimating a rise from USD 6.1 billion in 2023 to USD 14.36 billion by 2031, reflecting a compound annual growth rate (CAGR) of 11.3% over the forecast period.

The E-commerce Surge Increases the Demand of the Warehouse Robots

The flourishing e-commerce landscape, fueled by widespread internet access and diverse online marketplaces, necessitates efficient warehouse operations to manage high order volumes and ensure fast delivery times. Warehouse robots play a crucial role in automating tasks like picking, packing, and shipping, enabling faster order fulfillment and enhanced customer satisfaction.

Many industries are grappling with labor shortages, making it challenging to maintain adequate staffing levels in warehouses. Warehouse robots offer a solution by automating repetitive and physically demanding tasks, reducing reliance on manual labor, and improving worker safety. Warehouse operators are constantly seeking ways to optimize processes and increase throughput. Warehouse robots provide a compelling solution by automating tasks with precision and consistency, minimizing errors, and streamlining workflows.

Download Free Sample Report @ https://www.snsinsider.com/sample-request/2201

KEY PLAYERS:

- ABB Ltd.

- Kuka

- Amazon

- Fetch Robotics

- Honeywell International

- Fanuc Corporation

- Yaskawa Electric Corp.

- Yamaha Robotics

- Locus Robotics

- Omron Corporation

- Siemens

Market Analysis

The warehouse robotics market is a dynamic landscape driven by continuous innovation. This integration of technologies like Virtual Reality (VR), Augmented Reality (AR), Machine Learning (ML), and Artificial Intelligence (AI) facilitates the creation of "smart warehouses" where humans and robots collaborate seamlessly, optimizing operations and maximizing productivity.

Several recent developments further illustrate the momentum in the warehouse robotics market

• In May 2023, DHL partnered with Locus Robotics to introduce 5,000 autonomous mobile robots across its warehouses. These robots will take over picking, packing, and distribution tasks.

• In May 2023, DF Automation & Robotics launched a new brand of autonomous mobile robots (AMR) known as TITAN. These warehouse robots are specifically designed for handling heavy weights, up to 1.5 tons.

• In March 2023, South Korean manufacturer Thira Robotics introduced a new AMR in the U.S. market that offers advanced navigation capabilities in dynamic environments.

• In November 2022, Smart Robotics launched a robotic merchandise picker designed for warehouse and logistics operations, particularly for pick and place applications. This collaborative robot can handle lightweight products and assist with sorting inventory.

• In September 2022, ABB Ltd. rebranded ASTI mobile robotics under the new name Flexley mobile Robots, highlighting the inherent flexibility of autonomous mobile robot operations.

• In January 2022, ANSCER Robotics, an Indian startup, introduced its range of AMRs for various industries, including automotive, electronics, FMCG, and healthcare.

Segment Analysis

By Product Type, Automated guided vehicles (AGVs) dominated the market in 2023, holding the largest market share. AGVs efficiently move goods from one point to another within a warehouse, reducing operating costs and workforce requirements. They offer intelligent routing capabilities, preventing damage to products or personnel. These heavy-duty material handling solutions provide flexibility and scalability, with high

By Function, the transportation segment dominated the market in 2023 as robotics significantly enhanced product handling and delivery processes. These robots streamline loading and unloading tasks, accelerating the movement of goods and optimizing warehouse operations. E-commerce companies, in particular, are increasingly adopting transport robots to manage the rising volume of orders of diverse sizes and ensure efficient delivery.

By Industry, the e-commerce segment leads the market, fueled by the growing preference for online shopping and the increasing demand for fast and accurate order fulfillment. E-commerce companies are actively adopting warehouse robotics solutions to streamline their supply chain management and expedite order processing.

Make an Enquiry Before Buying @ https://www.snsinsider.com/enquiry/2201

Impact of Russia-Ukraine War

The ongoing conflict between Russia and Ukraine has disrupted global supply chains, causing shortages of raw materials and components for warehouse robotics. This has led to increased manufacturing costs and delayed deliveries, hindering market growth.

Impact of Economic Slowdown

Economic slowdowns can negatively affect the warehouse robotics market as businesses may postpone or reduce investments in automation. However, the long-term benefits of warehouse robotics, such as cost reduction and improved efficiency, may incentivize companies to continue adopting these technologies even during economic downturns.

Example-

A prominent e-commerce company experienced a 30% increase in order fulfillment speed and a 20% reduction in labor costs after implementing warehouse robots. This example highlights the tangible benefits that warehouse robotics can deliver.

Asia Pacific region led the Warehouse Robotics Market in 2023.

- This dominance is due to the rapid expansion of e-commerce and the increasing demand for efficient warehouse operations in emerging economies. The surge in online shopping, coupled with the growing preference for omnichannel distribution, has led to a significant increase in inventory volume in warehouses across the region. To manage this growing inventory efficiently and meet consumer expectations for fast delivery, warehouse owners are increasingly turning to robotics solutions.

- China, in particular, is witnessing a surge in demand for warehouse robots, fueled by the booming e-commerce and logistics sectors. The government's supportive policies, coupled with increased investments in logistic parks and the growing adoption of smart warehousing concepts, are further accelerating the adoption of warehouse robots in the country.

Key Takeaways

• The warehouse robotics market is projected to experience substantial growth in the coming years, driven by the e-commerce boom, labor shortages, and the need for increased efficiency.

• Industry 4.0 technologies, such as AI, ML, and IoT, are revolutionizing warehouse robotics, making robots more intelligent, adaptable, and collaborative.

• The Asia Pacific region, led by China, is expected to dominate the market due to the rapid expansion of e-commerce and supportive government policies.

• The warehouse robotics market presents lucrative investment opportunities, with venture capitalists actively funding innovative robotics companies.

Table of Content – Analysis of Key Points

Chapter 1. Executive Summary

Chapter 2. Global Market Definition and Scope

Chapter 3. Global Market Dynamics

Chapter 4. Warehouse Robotics Market Impact Analysis

Chapter 4.1 COVID-19 Impact Analysis

Chapter 4.2 Impact of Ukraine- Russia war

Chapter 4.3 Impact of ongoing Recession

Chapter 5. Value Chain Analysis

Chapter 6. Porter’s 5 forces model

Chapter 7. PEST Analysis

Chapter 8. Warehouse Robotics Global Market, by Type

Chapter 9. Warehouse Robotics Global Market, by Function

Chapter 10. Warehouse Robotics Global Market, by Payload Capacity

Chapter 11. Warehouse Robotics Global Market, by Industry

Chapter 12. Regional Outlook

Chapter 13. Competitive Intelligence

Chapter 14. Key Companies Analysis

Chapter 15. Research Process

Continued…

Buy Single User License @ https://www.snsinsider.com/checkout/2201

Contact us:

Akash Anand

Head of Business Development & Strategy

info@snsinsider.com

Phone: +1-415-230-0044 (US) | +91-7798602273 (IND)

Read Related Reports:

Milking Robots Market

Medical Electronic Market

Electronic Toll Collection Market

Akash Anand

SNS Insider Pvt. Ltd

+ +1 415-230-0044

info@snsinsider.com

Visit us on social media:

Facebook

Twitter

LinkedIn

Instagram

YouTube