Webb County’s Residential Property Values Took Off In 2024, Reaching New Heights

O'Connor determined that the residential property values in Webb County experienced a significant increase in 2024, reaching a new level.

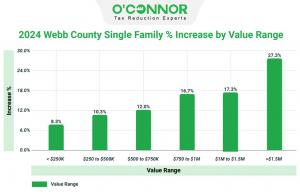

LAREDO, TEXAS, UNITED STATES, June 27, 2024 /EINPresswire.com/ -- Residential Values Rise by 10%The Webb County property market has experienced a significant surge, particularly notable with properties valued over $1.5M increasing by 27.3% and those in the $1M to $1.5M range surging by 17.3%. Overall, there has been a substantial 10.0% increase in total property value during this period, signaling strong demand and favorable market conditions.

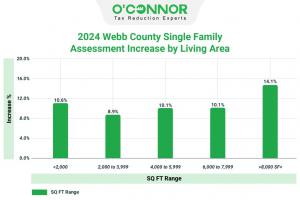

Home values are on the rise across the board! From smaller dwellings to spacious estates, the market is up 10.0% overall. Even larger homes, over 8,000 square feet, have seen a significant 14.1% increase. Conversely, properties ranging from 2,000 to 3,999 square feet have also contributed positively with an 8.9% uptick in value.

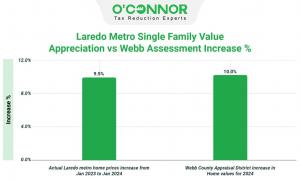

Comparing Laredo Metro Home Price Increases to Webb County’s Appraised Values for 2024

Following the 2024 property tax reassessment in Webb County, the WCAD raised home values by 10%. In contrast, the Laredo Association of Realtors reported a solid 9.5% increase in property values within the Laredo Metro area from January 2023 to January 2024.

Favorable Increases in Webb County Home Assessments for 2024 by Year

Homes constructed before 1960 and properties lacking a specified build year, categorized as “others,” both experienced a similar growth, with a 16% increase in value. Webb County’s home assessments underwent reevaluation in 2024, revealing varied increases, contributing to the overall 10% upward trend.

The Webb County Appraisal District identified 761 residential accounts as accurately or marginally overestimated, constituting 51% of the total, while 727 accounts were categorized as overvalued, amounting to 49%. This study scrutinizes the precision of property assessments by juxtaposing the sales prices of residences in 2023 with their 2024 property tax reassessment values.

Insights into WCAD’s 2024 Webb County Property Tax Revaluation

Currently, property owners in Webb County are seeing a significant increase in residential property values, exceeding the already spectacular growth rates seen in the busy Laredo metro region. Although the residential real estate industry has been profitable, its story is filled with interesting subtleties: some areas see great advancements, while others face difficult decreases. Many homeowners openly admit that the value of their residential homes has declined in recent decades. This occurrence may be attributed to several sources, one of which is the increase in interest rates from a small 1.71% in January 2022 to a more significant 4.05% by January 2024. Moreover, this story is also shaped by the continual fluctuation of income patterns, which are closely connected to the continuous increase in liability insurance and other maintenance expenses.

Challenge the Assessed Value of Your Property Annually

Texas property owners, and Webb County residents in particular, are both entitled to and encouraged to contest the assessed value of their property. During the appeal procedure, owners of both commercial and residential properties could contest what they perceive as an excessive assessment by submitting evidence. Owners should seriously contemplate legal action due to the high success rate of appeals and property tax consulting firms. O’Connor’s extensive heritage, which spans over fifty years, qualifies her to advocate for the rights of property proprietors. Furthermore, O’Connor is committed to assisting property proprietors in reducing taxes in a cost-effective and efficient manner, utilizing their wealth to achieve this.

About O'Connor

O’Connor is among the largest property tax consulting firms in the United States, providing residential property tax reduction services in Texas, Illinois, and Georgia, as well as commercial property tax reduction services across the United States. O’Connor’s team of professionals possess the resources and market expertise in the areas of property tax, cost segregation, commercial and residential real estate appraisals. The firm was founded in 1974 and employs more than 900 professionals worldwide. O’Connor’s core focus is enriching the lives of property owners through cost effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™. There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.

Patrick O'Connor, President

O'Connor

+ + +1 713-375-4128

email us here

Visit us on social media:

Facebook

X

LinkedIn

YouTube