Indonesia Logistics Market: 15.93% YoY Growth in Q1 2023 - Warehousing and Cold Chain Sectors Drive Economic Expansion

Indonesia's strategic investments in logistics and cold chain infrastructure are propelling the Indonesia Logistics Market to new heights, enhancing competitiveness and economic growth.

Explore Indonesia's logistics boom with a 15.93% YoY rise, driven by warehousing and cold chain sectors amid robust economic growth.

Efficient logistics is the backbone of a competitive economy, driving growth and connectivity in the Indonesia Logistics Market on both regional and global scales.”

JAKARTA, INDONESIA, July 16, 2024 /EINPresswire.com/ -- The Indonesia logistics and warehousing market is experiencing a period of unprecedented growth, driven by significant advancements in the warehousing and cold chain sectors. With the Indonesian economy rebounding post-pandemic, the logistics industry has emerged as a crucial driver of economic expansion, marked by strategic investments, infrastructural enhancements, and robust demand across various sectors.— Meetu Bhasin

Over the past two years, the Indonesia logistics market, including the Indonesia warehousing market, has experienced rapid growth. This growth is highlighted by a remarkable 15.93% year-on-year (YoY) increase in the transportation and warehousing sectors in the first quarter of 2023. This surge underscores the sector's resilience and adaptability amidst challenging global economic conditions, continuing to be pivotal in facilitating trade and supporting Indonesia's economic growth.

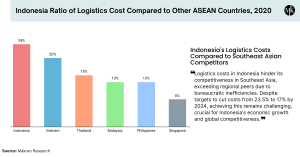

Reducing Logistics Costs: Strategic Goals and Initiatives in the Indonesia Logistics Market

The Indonesian National Development Planning Ministry and the head of the National Development Planning Agency (Bappenas) aim to reduce the country's logistics costs to 9% of GDP by 2045, down from the current 23.27%. Efforts are underway to cut logistics and supply chain costs to 17% by 2024 through initiatives such as the development of a national logistics platform and a sea toll program. These measures are crucial for enhancing the Indonesia Logistics Market, although achieving these targets may require an extended timeline to boost the nation's competitiveness in regional and global markets.

Indonesia's Export-Import Landscape: Key Commodities and Economic Outlook

Indonesia's abundant natural resources, including crude oil, natural gas, tin, copper, and gold, drive its primary exports. In March 2023, exports totaled USD 23.4169 billion, dropping to USD 19.29 billion in April 2023, compared to USD 23.8 billion in December 2022. Top imports include machinery, equipment, chemicals, fuels, and foodstuffs. In 2022, Indonesia ranked 24th in total exports, 27th in imports, and 61st in the Economic Complexity Index (ECI). Post-pandemic recovery has been fueled by commodity-led exports, but economic growth may slow due to fluctuating commodity prices and global monetary policies. As Indonesia strengthens its role as a global trader, it continues to address challenges posed by its physical demographics.

Indonesia as a Global Trade Hub: Strategic Seaports and Infrastructure

Indonesia holds a pivotal position for global traders due to its highly sophisticated supply chain infrastructure. The country boasts approximately 318 seaports, with Tanjung Priok handling a significant portion of international trade activities—accounting for 50% of total operations. These seaports are instrumental in facilitating and processing a substantial portion of international trade operations, making Indonesia significant as a strategic location for worldwide traders.

Indonesia's Logistics Sector: Growth and Trends

Since the onset of the pandemic, Indonesia's logistics sector has seen notable advancements, driving business and economic growth. Data from the Central Statistics Agency (BPS) indicates consistent growth across three consecutive quarters in 2022, with the sector outperforming other industries. Although domestic cargo has not yet returned to pre-pandemic levels, it experienced a 22.38% growth rate between 2018 and 2019, while international cargo grew by 39.30% between 2019 and 2020. The sector's contribution is projected to rise significantly, reaching IDR 957.9 trillion by the end of 2022, compared to IDR 719.6 trillion in the previous year.

Surge in Mergers and Acquisitions in the Indonesia Logistics Sector

Recent years have seen a surge in mergers and acquisitions within the Indonesia logistics market, leading to the establishment of regional core shipping and logistics hubs, as well as provincial warehousing and fulfillment centers. Key players are poised to drive innovation and shape the future of logistics in Indonesia. Notable transactions include:

► J&T Express: Acquired Shenzhen Fengwang Information Technology Co., Ltd. for RMB 1.183 billion.

► Gojek and Tokopedia Merger: Formed GoTo, an USD 18 billion conglomerate focusing on food delivery, ride-hailing, and e-commerce.

► Waresix and Trukita Acquisition: Waresix acquired Trukita, consolidating their position as one of Indonesia's largest logistics providers.

► Sicepat Funding: Closed a USD 170 million series B funding round, backed by Falcon House Partners, MDI Ventures, and others.

Advancements in Indonesia's Maritime Industry

Indonesia's maritime industry is one of the largest and is expected to contribute 15% to the GDP by 2045, compared to 3.6% in 2023. The sector is a significant source of employment, with approximately 12 million employees and growing. The Ministry of National Development Planning (Bappenas) aims to increase the marine protected area to 97.5 million hectares of Indonesia’s water by 2045 and increase employment in the sector to 12% of total employment by 2045.

Cold Chain Market in Indonesia: Growth and Opportunities

The Indonesia cold chain market is experiencing robust growth, driven by increasing demand for temperature-controlled logistics solutions. The country's expanding food and pharmaceutical sectors are key contributors to this growth. Strategic investments and partnerships are enhancing the cold chain infrastructure, positioning Indonesia as a regional leader in this segment. The Indonesian cold storage market is poised for strong expansion, with a Compound Annual Growth Rate (CAGR) estimated at 14.12%.

Future Prospects and Infrastructure Developments in the Indonesia Logistics Market

In Indonesia, the logistics industry is set for significant growth in the coming years. One major challenge facing the Indonesian logistics market is its high costs. However, the government is committed to improving logistics cost efficiency, aiming to reduce national logistics costs to 8-9% of GDP as part of the Golden Indonesia Vision 2045. Strategic investments and technological advancements are expected to drive this transformation.

Indonesia boasts a comprehensive transportation network, including approximately 318 seaports, 683 airports, and major national highways such as the Trans-Java and Trans-Sumatra Highways. The government's ongoing investments in infrastructure are enhancing logistics capabilities and supporting the sector's growth.

Scope of Indonesia Logistics and Warehousing Market Report

The Indonesia logistics and warehousing market report provides an in-depth analysis of key trends, drivers, and challenges. It offers insights into market size, competitive landscape, and regulatory framework. The report assesses warehousing infrastructure, transportation networks, the impact of COVID-19, and the cold chain sector, highlighting major players and their strategies. It aims to equip stakeholders with valuable insights for informed decision-making and effective navigation of the evolving market landscape.

Saurabh Adsule

Makreo Research and Consulting

+91 96196 99069

saurabh@makreo.com